Latin America. Throughout 2021, the office market in Latin America presented a mixed behavior, where absorptions improved overall, either they registered positive numbers or, at least, they reduced their negative volume.

Five of the 11 markets analyzed showed inventory growth of less than 0.3% over the previous half. The volume under construction increased by more than 450 thousand m², closing the year at 2.95 million square meters.

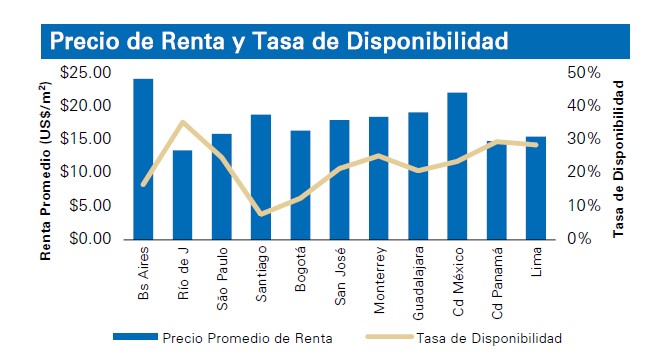

This is clear from the report of the corporate market in Latin America, prepared by the 11 teams of the Market Research division of Newmark directed by Juan Flores, and which highlights that, although the volume under construction increased for the second half of 2021 from 2.50 to 2.95 million square meters, we do not lose sight of the availability rate of the sector, which was presented, on average, at 22.8%. On this indicator, only the markets of Santiago, Bogotá and Buenos Aires have a rate below 20%, contrary to the cases of Rio, Panama City and Lima, which are close to or above 30%. As for the average rental price, it fell in most markets, but the decline in Brazilian cities was striking.

Among the markets analyzed by Newmark, whose president in Mexico and regional director for Latin America is Giovanni D'Agostino, are:

Buenos Aires, Argentina

During the year 2021, different scenarios were observed that began with a strong recession during the first quarter, observing the direct impact of the pandemic within a very deteriorated economy, and at the end of the year, there was an improvement in the indicators. Already with some stability, it can be pointed out that the market is in a moment of stand by that is waiting for the direction that the new cycle of the health crisis and the economic situation of the country has to take. Net absorption continues on a positive path, although very few hires were observed, while the annual accumulated continued in negative values. The area released is receding, as a result of specific operations, while income values seem to have found ground after two years in decline.

Rio de Janeiro, Brazil

In 2021, the Brazilian economy was recovering and government accounts improved so GDP is expected to experience growth and the services sector shows that this recovery is on track, despite the fact that, although there is a slight improvement, unemployment remains high. Regarding the office market, the returns of spaces were not very significant and the activity remained high, driving the net absorption of 22 thousand m2 for the second consecutive quarter. The availability rate at 4Q21 was 35.4%, slightly below the previous period. While it hasn't been as impacted by office remodels that resulted in returns, all indications are that the worst is over. This puts pressure on rental prices, which have been falling since 2017. A large number of buildings under construction have not defined their delivery date, so oversupply levels are not expected to worsen.

Sao Paulo, Brazil

For the fourth quarter of 2021, new occupations in top buildings in Sao Paulo registered the highest volume of the year with an increase of 168 thousand m2, which resulted in fewer office spaces being returned in this last period and the rate of evasion of tenants fell to levels of the end of 2020 - beginning of 2021, so the occupation went up and the net absorption in the 4Q was 70 thousand m2. The last quarter of the year saw the first substantial increase in office space occupancy since the beginning of the pandemic. After six continuous quarters of increased availability, by the end of the year this was reduced from 25.6% to 24.7%.

Santiago de Chile, Chile

The results of the presidential runoff gave the winner to the candidate of the Broad Front, Gabriel Boric, so the markets reacted with restraint, waiting to have clarity regarding the members of the economic team of the new government, which caused a contrast with the moderate optimism of the results of the previous quarter and the office market registered a high number of surface releases and the increase in vacancy. This time, overall availability stood at 7.7%, compared to 6.9% in 3Q2021. At the end of the year, almost all submarkets registered negative results compared to 2020, so taking into account the high levels of surface under construction, the political uncertainty that has not yet completely dissipated and the new trends in the workplace, a complex 2022 is anticipated.

Bogota, Colombia

In 2021 the economic reactivation was evident during the last quarter of the year which allowed economic analysts to review their projections for the economy and raised the bets for 2022, mainly due to the fact that high-frequency indicators are going very well, such as retail trade and industry which allowed that after two periods registering negative indicators, the market began to have positive levels of absorption exceeding the expectations projected in 2021. The annual absorption registered positive numbers, exceeding 20 thousand m2 and one of the main drivers of this dynamism has been the occupation of spaces by call center and BPO companies.

San Jose, Costa Rica

According to the Central Bank of Costa Rica, the country's production in November 2021 presented a year-on-year variation rate of 9.8%, consolidating the process of economic recovery by maintaining, since March 2021, growth rates with positive figures. However, due to the uncertainty experienced by users due to the current health crisis, the office market has suffered a significant deterioration. The increase in the availability rate and the decrease in demand place the market in an oversupply phase in line with the real estate cycle and a considerable delay in the negotiations has been observed. In addition, there is a greater interest of users to be located in temporary offices, due to the conditions of departure, short and medium term contracts, deliveries with all the necessary furniture and services, as well as the Free Zone regime.

Panama City, Panama

A crucial factor for the economic recovery in Panama has been the increase in foreign investments in areas such as mining, financial services and telecommunications, which in turn managed to reduce the levels of unemployment presented during 2020. According to data from the National Institute of Statistics and Census (INEC), the transport and communications, commerce, government services and health sectors performed positively throughout the second half of 2021.

This resulted in the office real estate market in Panama City since the last quarter of 2021 remaining in a recession phase according to the real estate cycle, with high levels of vacancy, a drop in rental prices and a disincentive in the construction of new properties.

Lima, Peru

Due to the fact that more than 63% of the population in Peru has already been vaccinated, most have been able to return to face-to-face work, so the unemployment rate was 9.1% between September and November, reducing by 4.2% compared to the period May – July 2021 and 39.7% compared to the same period of 2020. The net absorption of the second half of the prime office market is -34 thousand 896m², generating that the annual accumulated is located at -89 thousand 052m². With the entry of the new supply, plus the continuous vacancies registered in all submarkets, the vacancy index showed an increase of 5.6% compared to the previous period (39.5%) and stood at 28.6% of the total inventory. Due to the oversupply, the rental price continues to adjust downwards, causing the average rate to be US$ 15.50/m2, decreasing 1.27% compared to the previous quarter (US$ 15.70/m2).

Mexico City, Mexico

The Mexico City office market closed 2021 with a slight recovery in terms of net and gross absorption compared to the previous quarters of the year; however, forecasts are reserved for 2022. Once again, the growth of inventory during the last quarter (62 thousand 526 m²) was accompanied by an increase in the availability rate - the eighth consecutive - and closed the year with the highest figure recorded at 23.7%.

Guadalajara, Mexico

During the last quarter of 2021, the Guadalajara office market continued with a favorable behavior spinning for the second consecutive period modest but firm signs of recovery. In this period, the inventory did not increase, which has been beneficial for the recovery of the other indicators. There was a second continuous decline in the availability rate, which closed at 20.7%, and a new positive figure in the net absorption of the entire market, something uncommon in office markets under current conditions.

Monterrey, Mexico

The availability rate of the Class A+ and A office market reached 25.2%, equivalent to 335,117m2 unemployed. Conditioned spaces continue to have preference in the corporate market. Annually, 25,046m2 were registered for conditioned spaces, representing 73.3% of the total m2 registered as gross absorption (34,186m2) and 9,139m2 for spaces in gray work, which represent 26.7%.

"The outlook in the Office market in Latin America continues to be affected by the uncertainty of the most recent wave of the pandemic. Although there was an economic recovery, it failed to reach the expected levels at the end of 2021 in all sectors. It is expected that, by the second half of 2022, the recovery in the occupation of the office sector will be consolidated, since the importance of these spaces within the work dynamics has been highlighted, "said Giovanni D'Agostino, president in Mexico and regional director for Latin America of Newmark.

Source: Newmark.

Leave your comment